|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

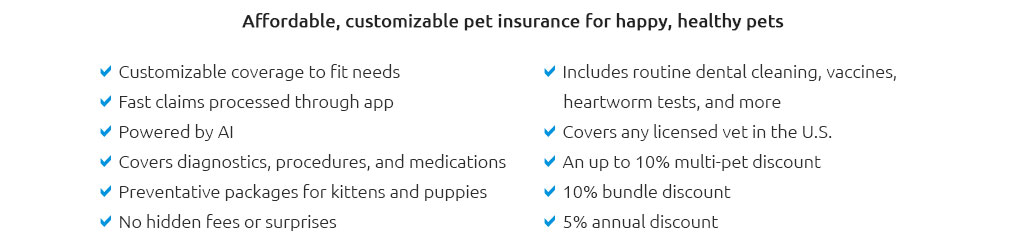

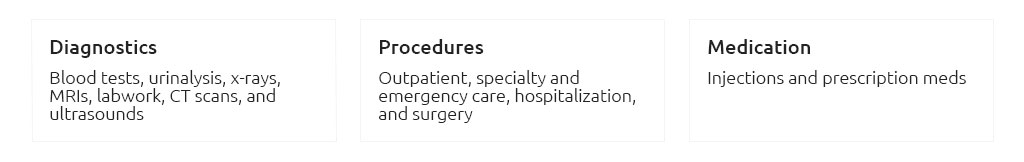

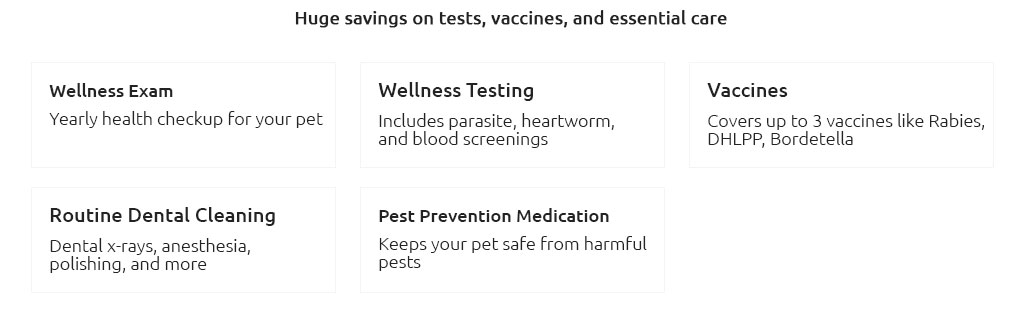

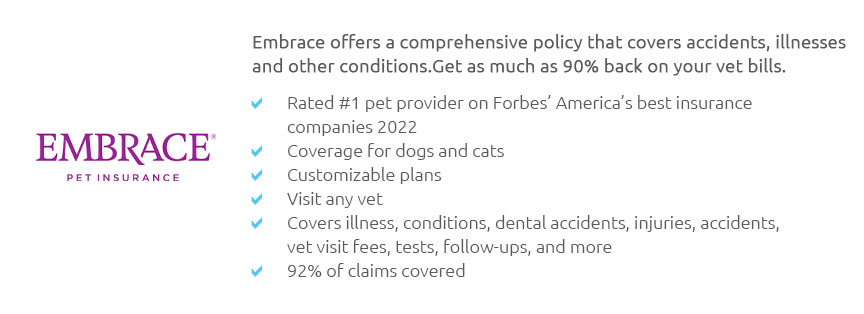

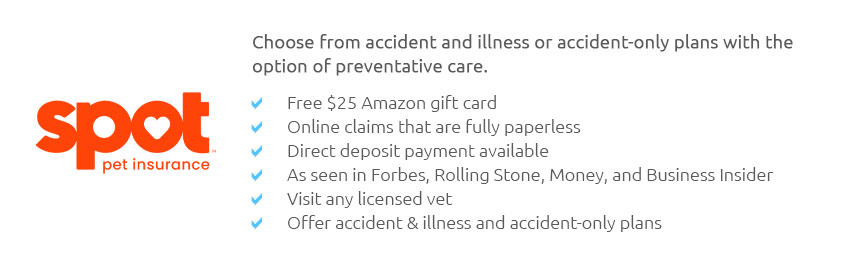

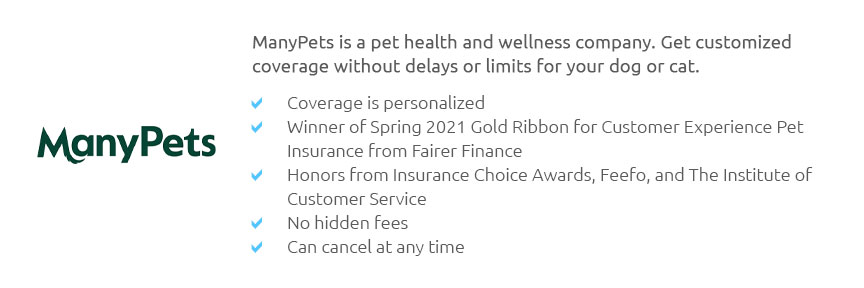

Exploring the Best Price Pet Insurance: Expert Tips and AdviceIn today’s world, where our pets are cherished members of the family, finding the best price pet insurance is more important than ever. Navigating the myriad options available can be a daunting task, but with a little insight and guidance, you can secure the most value for your beloved furry friend’s health. Pet insurance, at its core, is about peace of mind. It ensures that your pet can receive the care they need without you having to worry about exorbitant costs. However, not all pet insurance is created equal, and the best price isn’t always the cheapest option. When looking for the best price pet insurance, it’s crucial to understand what you’re actually paying for. The key lies in the details of the coverage. Comprehensive coverage often includes accidents, illnesses, hereditary conditions, and sometimes even routine care. Be wary of policies that seem too good to be true; they might be missing crucial coverages that could leave you with unexpected expenses. It’s always wise to read the fine print and understand the limits and exclusions of any policy you’re considering. Sometimes, a slightly higher premium can mean significantly better coverage, saving you money in the long run. Expert Tip: Always consider the deductible and reimbursement level. A lower deductible means you’ll pay less out-of-pocket before the insurance kicks in, but this usually results in a higher premium. Conversely, a higher deductible can lower your premium but requires more out-of-pocket spending before coverage starts. Balancing these elements is essential in finding the best price pet insurance for your needs. Moreover, it’s beneficial to consider the age and breed of your pet when selecting insurance. Younger pets often have lower premiums, while certain breeds may come with higher costs due to predispositions to specific health issues. Many insurance companies offer multi-pet discounts, which can be advantageous if you have more than one pet. Additionally, some insurers provide loyalty discounts or lower premiums for pets who are spayed or neutered, vaccinated, or microchipped. When evaluating your options, it can be helpful to compile a list of potential insurers. Here’s a brief guide to streamline your decision-making process:

In conclusion, finding the best price pet insurance is about more than just the monthly cost. It’s about understanding your pet’s unique needs, evaluating the coverage details, and ensuring the insurer is reputable and reliable. With these expert tips, you can navigate the complex landscape of pet insurance with confidence, knowing you’re making a well-informed decision for your pet’s health and your peace of mind. Remember, the goal is to protect your pet without breaking the bank, ensuring they lead a long, healthy, and happy life with you. https://www.comparethemarket.com/pet-insurance/

At Compare the Market, we only compare prices for pet insurance that covers dogs and cats, including puppies and kittens. https://www.aspcapetinsurance.com/

Find the best pet insurance plan for your pet. Shop pet insurance plans that cover wellness, illness, accidents & more. Use any vet. Get a free quote today! https://www.cbsnews.com/news/how-to-get-cheap-pet-insurance-according-to-veterinarians/

These tips will help you find the most affordable coverage offering the protection your pet deserves.

|